GnuCash is easy enough to use that you do not need to have a

complete understanding of accounting principles to find it useful.

However, you will find that some basic accounting knowledge will prove to

be invaluable as GnuCash was designed using these principles as a

template. It is highly recommended that you understand this section of the

guide before proceeding.

Basic accounting rules group all finance related things into 5 fundamental types of “accounts”. That is, everything that accounting deals with can be placed into one of these 5 accounts:

Account types

- Assets

Things you own

- Liabilities

Things you owe

- Equity

Overall net worth

- Income

Increases the value of your accounts

- Expenses

Decreases the value of your accounts

It is clear that it is possible to categorize your financial world into these 5 groups. For example, the cash in your bank account is an asset, your mortgage is a liability, your paycheck is income, and the cost of dinner last night is an expense.

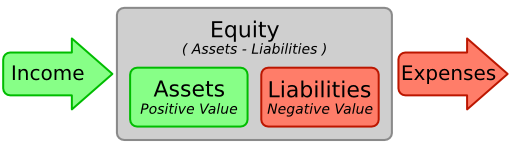

With the 5 basic accounts defined, what is the relationship between them? How does one type of account affect the others? Firstly, equity is defined by assets and liability. That is, your net worth is calculated by subtracting your liabilities from your assets:

Assets - Liabilities = Equity

Furthermore, you can increase your equity through income, and decrease equity through expenses. This makes sense of course, when you receive a paycheck you become “richer” and when you pay for dinner you become “poorer”. This is expressed mathematically in what is known as the Accounting Equation:

Assets - Liabilities = Equity + (Income - Expenses)

This equation must always be balanced, a condition that can only be satisfied if you enter values to multiple accounts. For example: if you receive money in the form of income you must see an equal increase in your assets. As another example, you could have an increase in assets if you have a parallel increase in liabilities.

Figure 2.1. The basic accounts relationships

A graphical view of the relationship between the 5 basic accounts. Net worth (equity) increases through income and decreases through expenses. The arrows represent the movement of value.

The accounting equation is the very heart of a double entry

accounting system. For every change in value of one account in the

Accounting Equation, there must be a balancing change in another. This

concept is known as the Principle of Balance, and

is of fundamental importance for understanding GnuCash and other double

entry accounting systems. When you work with GnuCash, you will always be

concerned with at least 2 accounts, to keep the accounting equation

balanced.

Balancing changes (or transfers of money) among accounts are done by debiting one account and simultaneously crediting another. Accounting debits and credits do not mean “decrease” and “increase”. Debits and credits each increase certain types of accounts and decrease others. In asset and expense accounts, debits increase the balance and credits decrease the balance. In liability, equity and income accounts, credits increase the balance and debits decrease the balance.

In traditional double-entry accounting, the left column in the

register is used for debits, while the right column is used for credits.

Accountants record increases in asset, expense, and equity accounts on the

debit (left) side, and they record increases in liability, revenue, and capital

accounts on the credit (right) side. GnuCash

follows this convention in the register.

| Note |

|---|---|

This accounting terminology can be confusing to new users,

which is why | |

| Warning |

|---|---|

Common use of the words debit and credit does not match how accountants use these words. In common use, credit generally has positive associations; in accounting, credit is associated with decreases in asset, expense and equity accounts. | |