The tax report allows you to export all tax related Income and Expenses to a TXF (Tax eXchange Format) file in addition to the html format that all reports allow. The TXF file can be imported into tax filing programs such as TaxCut or TurboTax.

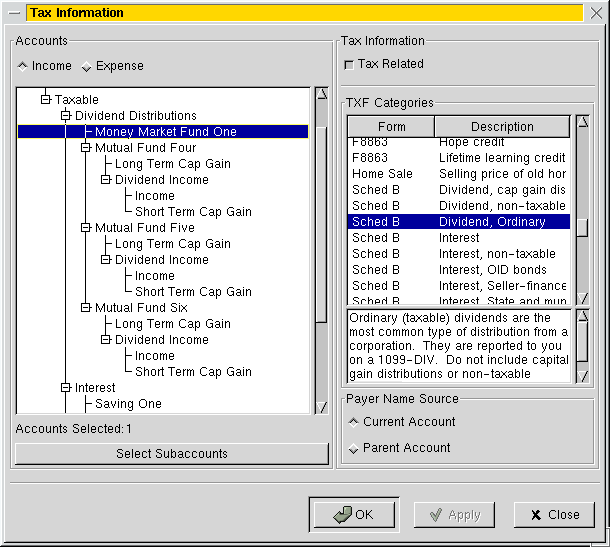

NOTE: For this to work, the user has to segregate taxable and not taxable income to different accounts, as well as deductible and non deductible expenses. The user also must Set the TXF category of each tax related account. The "Tax Information" dialog on the "Accounts" menu is used for this. It is best to set this up before actually exporting, otherwise, you will just get an empty file. There is a taxreport.xac file in the examples directory, which shows one way this can be set up.

IMPORTANT: Most TXF codes should only appear on a single account! The exceptions are codes for which the "Payer Name Source" is not grayed, each of which can appear many times. Of course, each duplicate should have a unique payer name. These are typically interest accounts or stocks or mutual funds that pay dividends.

Accounts: for which to set a TXF category. If no account is selected nothing is changed. If multiple accounts are selected, all of the Income accounts will be set to the selected item.

TXF categories: Select the desired one. A detailed description appears just below.

Payer Name Source: A text description that is exported along with the value of the account. This is usually the name of a bank, stock, or mutual fund that pays dividends or interest. Occasionally, it is a description of a deduction.

In the Accounts list box above, "Money Market Fund One" is an example of where the name of the current account is exported. This is typically used when the fund pays only one type of income, such as interest. For "Mutual Fund Four" and "Mutual Fund Five", the categories "Long Term Cap Gain" and "Dividend Income" both will export the name of the parent account. This is typically used when the fund pays several different types of distributions. As shown in this example, these funds have three types of distributions, but the "Income" and "Short Term Cap Gain" categories are totaled and exported together as "Dividend Income", as they are taxed the same.