Let’s suppose you buy an asset expected to increase in value, say a Degas painting, and want to track this. (The insurance company will care about this, even if nobody else does.)

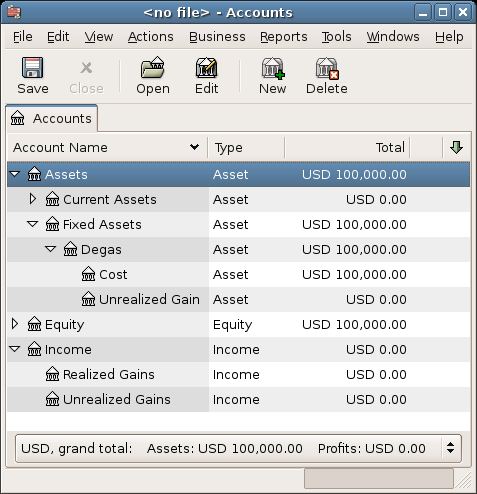

Start with an account hierarchy similar to that shown in Section 11.3, “Account Setup”, but replace ITEM1 with Degas and remove the ITEM2 accounts. We will assume that the Degas painting had an initial value of one hundred thousand dollars. Begin by giving your self $100,000 in the bank and then transferring that from your bank account to your Assets:Fixed Assets:Degas:Cost account (the asset purchase transaction). You should now have a main account window which appears like this:

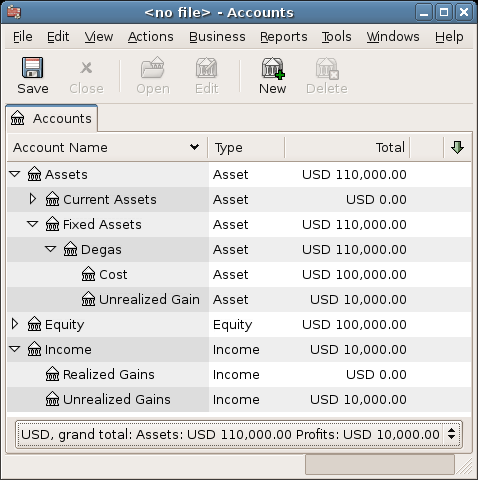

A month later, you have reason to suspect that the value of your painting has increased by $10,000 (an unrealized gain). In order to record this you transfer $10,000 from your Income:Unrealized Gains account to your Assets:Fixed Assets:Degas:Unrealized Gains account. Your main window will resemble this:

Let’s suppose another month later prices for Degas paintings have gone up some more, in this case about $20,000, you estimate. You duly record the $20,000 as an unrealized income like above, then decide to sell the painting.

Three possibilities arise. You may have accurately estimated the unrealized gain, overestimated the unrealized gain, or underestimated the unrealized gain.

Accurate estimation of unrealized gains.

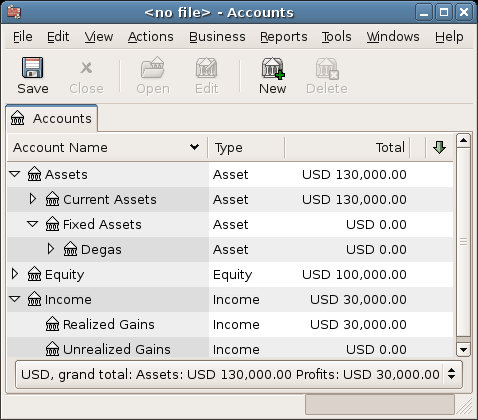

Your optimistic estimate of the painting’s value was correct. First you must record that the profits made are now realized gains, not unrealized gains. Do this by transferring the income from the Income:Unrealized Gains to the Income:Realized Gains account.

Secondly, you must credit your bank account with the selling price of the painting. This money comes directly from your Assets:Fixed Assets:Degas sub-accounts. Transfer the full Assets:Fixed Assets:Degas:Cost value into Assets:Current Assets:Savings, and the full Assets:Fixed Assets:Degas:Unrealized Gains into Assets:Current Assets:Savings.

These transactions should now appear as follows:

Table 11.1. Turning an Unrealized Gain into a Realized Gain - Accurate Estimation

Account Transfer to Transaction Amount Account Total Income:Unrealized Gains Income:Realized Gains $30,000 $0 Assets:Fixed Assets:Degas:Cost Assets:Current Assets:Savings $100,000 $0 Assets:Fixed Assets:Degas:Unrealized Gains Assets:Current Assets:Savings $30,000 $0

This leaves the Assets:Current Assets:Savings account with a total of $130,000 and Income:Realized Gains with a total of $30,000.

Over estimation of unrealized gains.

You were over-optimistic about the value of the painting. Instead of the $130,000 you thought the painting was worth you are only offered $120,000. But you still decide to sell, because you value $120,000 more than you value the painting. The numbers change a little bit, but not too dramatically.

The transactions should now appear as follows (observe the last transaction which balances the Unrealized Gains account):

Table 11.2. Turning an Unrealized Gain into a Realized Gain - Over estimation

Account Transfer to Transaction Amount Account Total Income:Unrealized Gains Income:Realized Gains $20,000 $10,000 Assets:Fixed Assets:Degas:Cost Assets:Current Assets:Savings $100,000 $0 Assets:Fixed Assets:Degas:Unrealized Gains Assets:Current Assets:Savings $20,000 $10,000 Assets:Fixed Assets:Degas:Unrealized Gains Income:Unrealized Gains $10,000 $0

This leaves the Assets:Current Assets:Savings account with a total of $120,000 and Income:Realized Gains with a total of $20,000.

Under estimation of unrealized gains.

You manage to sell your painting for more than you thought in your wildest dreams ($150,000). The extra value is, again, recorded as a gain, that is an income.

The transactions should now appear as follows (observe the last transaction which balances the Unrealized Gains accounts):

Table 11.3. Turning an Unrealized Gain into a Realized Gain - Under estimation

Account Transfer to Transaction Amount Account Total Income:Unrealized Gains Income:Realized Gains $50,000 $-20,000 Assets:Fixed Assets:Degas:Cost Assets:Current Assets:Savings $100,000 $0 Assets:Fixed Assets:Degas:Unrealized Gains Assets:Current Assets:Savings $50,000 $-20,000 Income:Unrealized Gains Assets:Fixed Assets:Degas:Unrealized Gains $20,000 $0

This leaves the Assets:Current Assets:Savings account with a total of $150,000 and Income:Realized Gains with a total of $50,000.