Sales Tax Tables can used to determine the tax for customer invoices (or vendor bills).

A tax table entry can be assigned to an invoice line or bill line.

Set up distinct tax tables for customers and vendors.

The default invoice tax table entry can be assigned to each customer and the default bill tax table entry can be assigned to each vendor.

The default tax table entry for new customers or new vendors can be specified in the Book Options window which can be accessed by → →

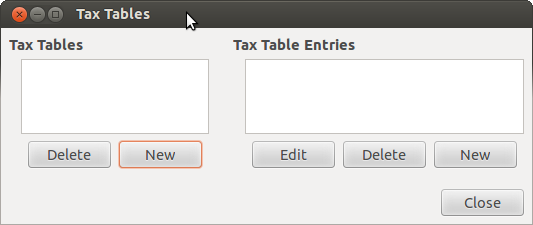

Sales Tax Tables are maintained using the Sales Tax Table editor which is accessed via menu → .

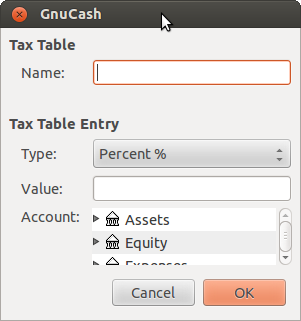

Name This is the tax table name.

Type Either Percent % or Value $.

Value This is the percentage or value depending on Type.

Account This is the account to which tax will be posted. For tax collected from customers, this should probably be a Liability account as it must be payed to the government. For tax paid to vendors, if tax laws allow tax paid to vendors to offset tax collected from customers, this should probably also be a Liability account (even though it will usually have a debit balance) so that the net tax owed to the government can be easily observed.

If you set up Tax on Purchases and Tax on Sales as subaccounts of Liabilities:Tax then the net tax will be rolled up and can be seen in the

GnuCashAccounts tab.If unsure about tax law requirements, get professional advice.

The following charts illustrate sample tax tables and may be used as starting points to determine the setup appropriate for a particular jurisdiction.

Tabela 12.1. Sample Tax Table Entries for EU country (e.g. 21% / 6% / 0% Belgium, 20% / 5% / 0% UK etc.) (2017)

| Tax Table | Tax Table Entries [Asset/Liability] | Percentage or Amount |

|---|---|---|

| Standard VAT Sales | VAT:Sales:Standard [L] | 21% |

| Reduced VAT Sales | VAT:Sales:Reduced [L] | 6% |

| Zero-Rated VAT Sales | VAT:Sales:Zero [L] | 0% |

| EC Sales | VAT:Sales:EC [L] | 21% |

| VAT:Sales:Reverse EC [L] | -21% | |

| Standard VAT Purchases | VAT:Purchases:Standard [A] | 21% |

| Reduced VAT Purchases | VAT:Purchases:Reduced [A] | 6% |

| Zero-Rated VAT Purchases | VAT:Purchases:Zero [A] | 0% |

Tabela 12.2. Sample Tax Table Entries for Australia (2017)

| Tax Table | Tax Table Entries [Asset/Liability] | Percentage or Amount |

|---|---|---|

| Standard GST Sales | GST:Sales:Standard [L] | 10% |

| GST-free Sales | GST:Sales:Zero [L] | 0% |

| Standard GST Purchases | GST:Purchases:Standard [A] | 10% |

| GST-free Purchases | GST:Purchases:Zero [A] | 0% |

Tabela 12.3. Sample Tax Table Entries for Cook County, Illinois (2017)

| Tax Table | Tax Table Entries [Asset/Liability] | Percentage or Amount |

|---|---|---|

| Chicago Sales Taxes | Taxes:Sales:State [L] | 6.25% |

| Taxes:Sales:City [L] | 1.25% | |

| Taxes:Sales:County [L] | 1.75% | |

| Taxes:Sales:Region [L] | 1% |