Now that we have covered the basic ideas behind the various

transactions you must make to successfully track your credit card in

GnuCash, let’s go through an example. In this example, we will make credit

card purchases, refund two of the purchases, get charged interest on

the unpaid balance, reconcile the credit card account, and finally make a

partial payoff of the credit card.

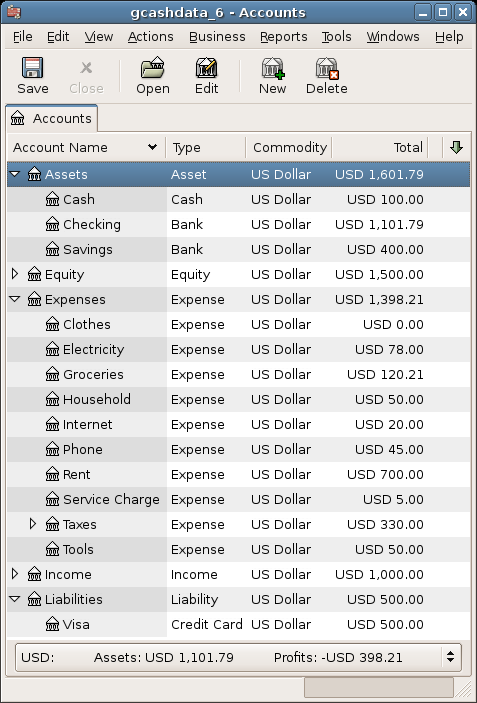

Start with opening the previous datafile we stored,

gcashdata_5, and store it as

gcashdata_6 directly. The main window should look

something like this:

Starting account structure for tracking a credit card in the putting it all together example.

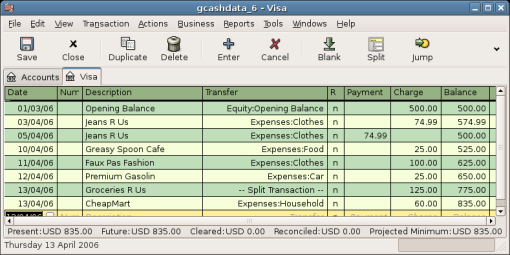

Let’s make some purchases on our visa card. Start by buying $25 worth of food from the Greasy Spoon Cafe, $100 worth of clothing from Faux Pas Fashions, $25 worth of gasoline from Premium Gasoline, $125 worth of groceries and household items from Groceries R Us (split between $85 in groceries and $40 in household items) and finally, $60 worth of household items from CheapMart.

We also redo the exercise in previous chapter, with purchasing a pair of Jeans for $74.99 on April 3, and refund them two days later.

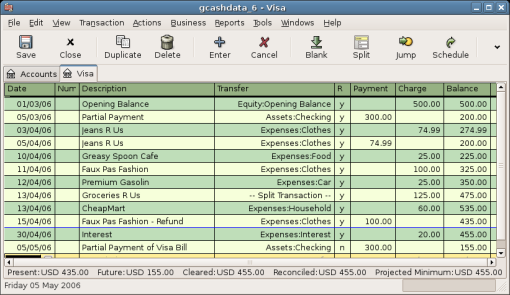

The register window for the credit card liability should look like this:

Initial credit card purchases.

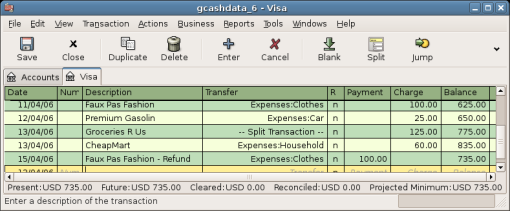

Now suppose that on April 15th you return the clothes you bought

on April 11th from Faux Pas Fashions and they give you credit back on

your credit card. Enter a transaction for the credit card refund for the

full $100 amount. Remember to use the same transfer account you used for

the original purchase, and enter the amount under the Payment column.

GnuCash will automatically complete the name and transfer account for

you, but it will also automatically enter the $100 in the Charge column.

You will need to reenter the amount in the Payment column. The

transaction looks like this:

Returning clothes to Faux Pas Fashions, refund to credit card.

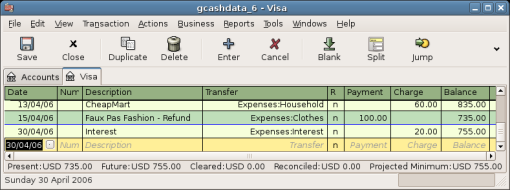

After the month of spending, unfortunately, the credit card bill arrives in the mail or you access it on-line through the internet. You have been charged $20 in interest on the last day of April because of the balance you carried from the previous month. This gets entered into the credit card account as an expense.

Interest charge.

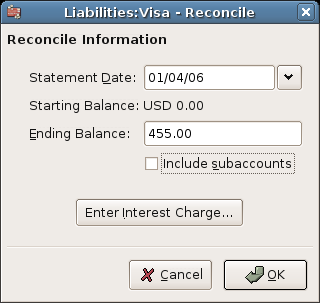

When your credit card bill arrives you should reconcile your

credit card account to this document. This is done using GnuCash’s

built-in reconciliation application. Highlight the credit card account

and click on → . This reconciliation procedure is

described in detail in the Section 4.5, “Reconciliation”,

but we will step

through the process here as well. For this example, let’s assume that

the credit card statement is dated May 1st, with a final balance of

$455. Enter these values in to the initial Reconcile window as shown

here.

Initial account reconciliation window.

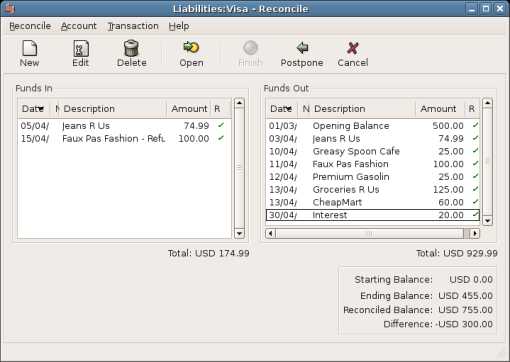

During the reconciliation process, you check off each transaction

in the account as you confirm that the transaction appears in both your

GnuCash account and the credit card statement. For this example, as

shown in the figure below, there is a $300 difference between your

GnuCash accounts and the credit card statement.

Main account reconciliation window, demonstrating a discrepancy of $300.

Some investigation uncovers that you forgot to record a payment

you made on March 5th to the credit card company for $300, you

must enter this payment transaction from your bank account to the credit

card. Now the credit card statement and your GnuCash account can be

reconciled, with a balance of $455.

Assuming you have completed reconciliation of your credit card account, you need to make a payment to the credit card company. In this example, we owe $455 but will make a partial payment of $300 again this month. To do so, enter a transaction from your bank account to the credit card account for $300, which should reduce your credit card balance to $155. Your credit card account register should now appear like this:

Account register after account reconciliation and payment.

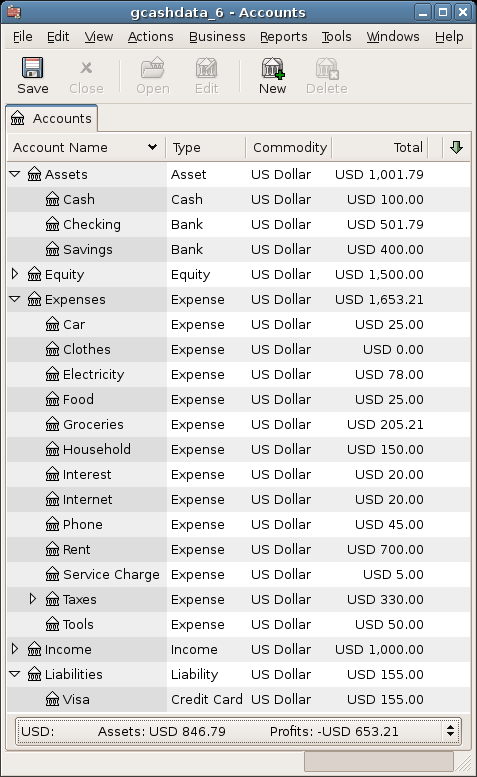

Go back to the main window and save your file

(gcashdata_6). Your chart of accounts is steadily

growing, and it should now look like this:

GnuCash Chart of Accounts after account reconciliation and

payment.

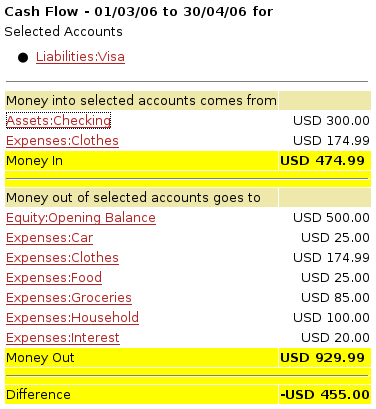

As we did in the previous chapters, let’s have a look at a Cash Flow, and a Transaction Report.

First let’s have a look at the Cash Flow report for the liability account Visa during the month of March.

Select the cash flow report from → → .

This image shows the Cash Flow report after Chapter 6, Credit Cards.

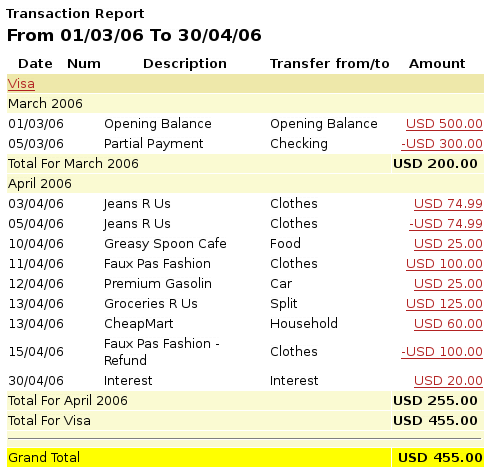

Now let’s have a look at corresponding transaction report for the Visa account.

Select the transaction report from → .

This image shows the Transaction Report for the Visa account during March/April.

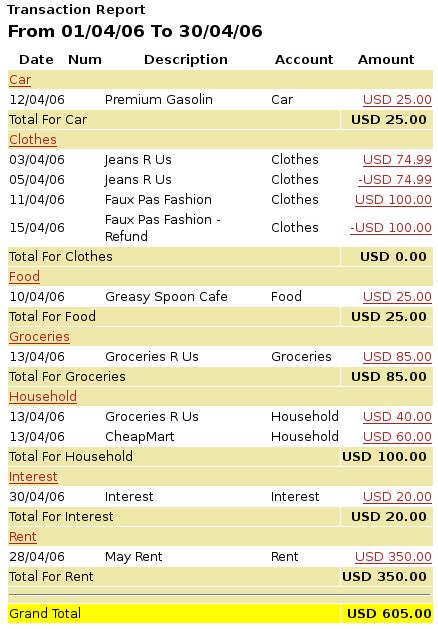

Now let’s change the transaction report to only show the various Expenses accounts.

This image shows the Transaction Report for the various Expense accounts during April.