A house mortgage can be setup using the account structure present in Section 8.2, “Setting Up Accounts”.

As an example, assume you have $60,000 in you Saving account, and you buy a $150,000 house. The mortgage is charging 6% APR, and has administrative fees (closing costs, etc) of 3%. You decide to put $50,000 down, and thus will need to borrow $103,000, which will give you $100 after the closing costs are paid (3% of $100,000).

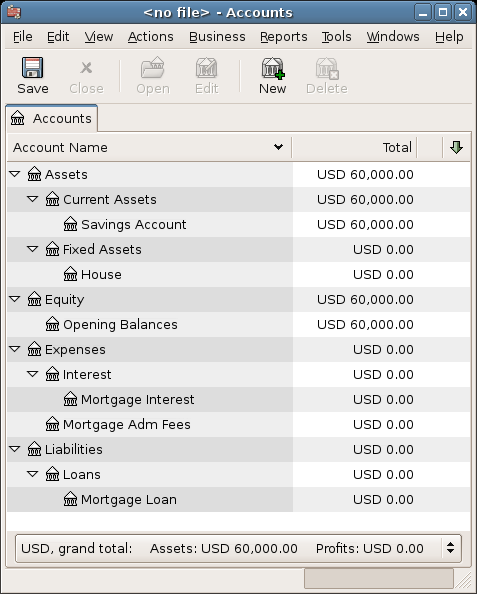

Your accounts before borrowing the money:

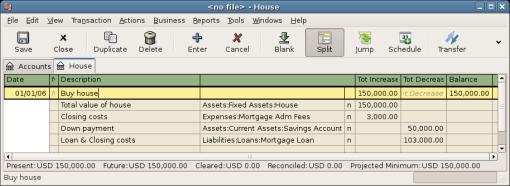

The purchase of the house is recorded with a split transaction in the Assets:Fixed Assets:House account, with $50,000 coming from the bank (i.e., your down payment), and $100,000 coming from the Mortgage. You can place the $3,000 closing costs in the same split, and we increase the house loan to $103,000 to include the closing costs as well.

Table 8.1. Buying a House Split Transaction

| Account | Increase | Decrease |

| Assets:Fixed Assets:House | $150,000 | |

| Assets:Current Assets:Bank | $50,000 | |

| Liabilities:Loans:Mortgage Loan | $103,000 | |

| Expenses:Mortgage Adm Fees | $3,000 |

The split will look like this in the Assets:Fixed Assets:House Account:

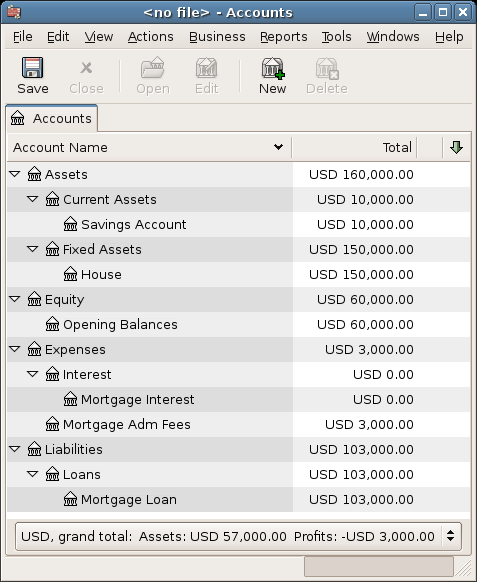

Which will give a Chart of Accounts like this: