This section will show how the GnuCash definition of an account fits

into the view of the 5 basic accounting types.

But first, let’s begin with a definition of an

account in GnuCash. A GnuCash

account is an entity which contains other

sub-accounts, or that contains transactions. Since an

account can contain other accounts, you often see account

trees in GnuCash, in which logically associated accounts are grouped

together within a common parent account.

A GnuCash account must have a unique name (that you assign) and one

of the predefined GnuCash “account types”. There are a total of 12 account

types in GnuCash. These 12 account types are based on the 5 basic

accounting types; the reason there are more GnuCash account types than

basic accounting types is that this allows GnuCash to perform specialized

tracking and handling of certain accounts. There are 6 asset accounts

(Cash, Bank,

Stock, Mutual Fund,

Accounts Receivable, and Other Assets),

3 liability accounts (Credit Card,

Accounts Payable, and Liability),

1 equity account (Equity), 1 income account

(Income), and 1 expense account

(Expenses).

These GnuCash account types are presented in more detail

below.

The first balance sheet account we will examine is Assets, which, as you remember from the previous section, refers to things you own.

To help you organize your asset accounts and to simplify

transaction entry, GnuCash supports several types of asset

accounts:

Cash Use this account to track the money you have on hand, in your wallet, in your piggy bank, under your mattress, or wherever you choose to keep it handy. This is the most liquid, or easily traded, type of asset.

Bank This account is used to track your cash balance that you keep in institutions such as banks, credit unions, savings and loan, or brokerage firms - wherever someone else safeguards your money. This is the second most liquid type of account, because you can easily convert it to cash on hand.

Stock Track your individual stocks and bonds using this type of account. The stock account’s register provides extra columns for entering number of shares and price of your investment. With these types of assets, you may not be able to easily convert them to cash unless you can find a buyer, and you are not guaranteed to get the same amount of cash you paid for them.

Mutual Fund This is similar to the stock account, except that it is used to track funds. Its account register provides the same extra columns for entering share and price information. Funds represent ownership shares of a variety of investments, and like stocks they do not offer any guaranteed cash value.

GnuCashtreats account types Stock and Mutual Fund the same.Accounts Receivable (A/Receivable) This is typically a business use only account in which you place outstanding debts owed to you. It is considered an asset because you should be able to count on these funds arriving.

Transactions involving an Accounts Receivable account should not be added, changed or deleted in any way other than by using

post/unpost bill/invoice/voucher or

process payment

Asset No matter how diverse they are,

GnuCashhandles many other situations easily. The account type “Asset”, covers all assets not listed above.GnuCashtreats account types Cash, Bank and Asset the same.Accounts are repositories of information used to track or record the kinds of actions that occur related to the purpose for which the account is established.

For businesses, activities being tracked and reported are frequently subdivided more finely than what has been considered thus far. For a more developed treatment of the possibilities, please read the descriptions presented in Chapter 15, Other Assets of this Guide.

For personal finances a person can follow the business groupings or not, as they seem useful to the activities the person is tracking and to the kind of reporting that person needs to have to manage their financial assets. For additional information, consult Chapter 15, Other Assets of this Guide.

The second balance sheet account is Liabilities, which as you recall, refers to what you owe, money you have borrowed and are obligated to pay back some day. These represent the rights of your lenders to obtain repayment from you. Tracking the liability balances lets you know how much debt you have at a given point in time.

GnuCash offers three liability account types:

Credit Card Use this to track your credit card receipts and reconcile your credit card statements. Credit cards represent a short-term loan that you are obligated to repay to the credit card company. This type of account can also be used for other short-term loans such as a line of credit from your bank.

Accounts Payable (A/Payable) This is typically a business use only account in which you place bills you have yet to pay.

Transactions involving an Accounts Payable account should not be added, changed or deleted in any way other than by using

post/unpost bill/invoice/voucher or

process payment

Liability Use this type of account for all other loans, generally larger long-term loans such as a mortgage or vehicle loan. This account can help you keep track of how much you owe and how much you have already repaid.

GnuCashtreats account types Credit Card and Liability the same.

| Tip |

|---|---|

Liabilities in accounting act in an opposite manner from assets: credits (right-column value entries) increase liability account balances and debits (left-column value entries) decrease them. (See note later in this chapter) | |

The final balance sheet account is Equity,

which is synonymous with “net worth”. It represents what is left over

after you subtract your liabilities from your assets, so it is the

portion of your assets that you own outright, without any debt. In

GnuCash, use this type of account as the source of your opening bank

balances, because these balances represent your beginning net

worth.

There is usually only a single GnuCash equity account, called naturally

enough, Equity.

For companies, cooperatives etc. you can create a subaccount for each partner.

| Tip |

|---|---|

In equity accounts, credits increase account balances and debits decrease them. (See note later in this chapter) | |

| Note |

|---|---|

The accounting equation that links balance-sheet accounts is Assets = Liabilities + Equity or rearranged Assets - Liabilities = Equity. So, in common terms, the things you own minus the things you owe equals your net worth. | |

Income is the payment you receive for your

time, services you provide, or the use of your money. In GnuCash, use an

Income type account to track these.

| Tip |

|---|---|

Credits increase income account balances and debits decrease them. As described in Section 2.1, “Accounting Concepts”, credits represent money transferred from an account. So in these special income accounts, when you transfer money from (credit) the income account to another account, the balance of the income account increases. For example, when you deposit a paycheck and record the transaction as a transfer from an income account to a bank account, the balances of both accounts increase. | |

Expenses refer to money you spend to purchase

goods or services provided by someone else. In GnuCash, use an

Expense type account to track your expenses.

| Tip |

|---|---|

Debits increase expense account balances and credits decrease them. (See note later in this chapter.) | |

| Note |

|---|---|

When you subtract total expenses from total income for a time period, you get net income. This net income is then added to the balance sheet as retained earnings, which is a type of Equity account. | |

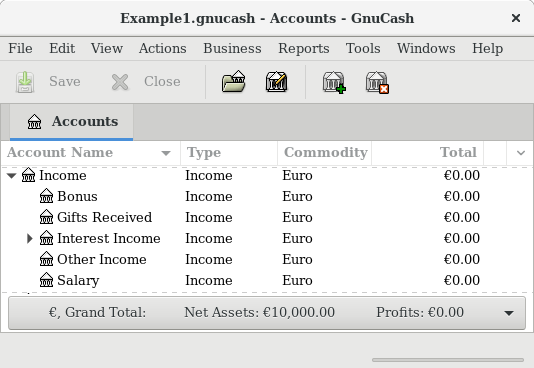

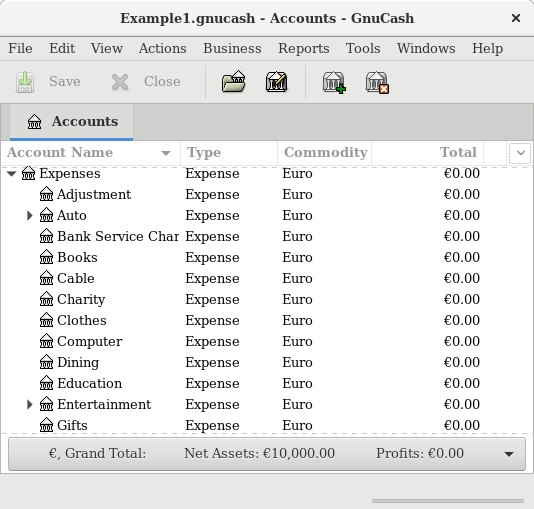

Below are the standard Income and Expense accounts after selecting Common Accounts in the assistant for creating a new Account Hierarchy ( → ).

There are some special other account types.

Trading Multiple currency transactions have splits in “Trading” accounts to make the transaction balance in each currency as well as in total value. See Chapter 12, Multiple Currencies for more information.

Money Market and Credit Line are used only in the OFX importer, apparently for completeness with the specification.