As we saw in the previous chapter, accounting is based on 5 basic

account types: Assets,

Liabilities, Equity,

Income and Expenses. We will now

expand on our understanding of these account types, and show how they are

represented in GnuCash. But first, let’s divide them into 2 groups, the

balance sheet accounts and the income and expense accounts.

As the name says the balance sheet accounts can be summarized in the

balance of what you own and owe at a point in the time,

while the income and expense accounts can be summarized in the Profit & Loss report,

which shows the change of values in a period of time like the economic year

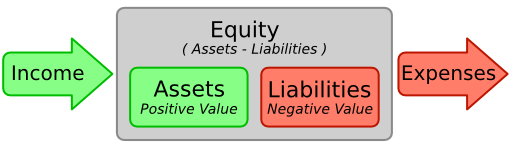

Let’s have a quick look at the Accounting Equation (Assets - Liabilities = Equity + (Income - Expenses)) again as a reminder, before we go deeper into each account type.

A graphical view of the relationship between the 5 basic accounts. Net worth (equity) increases through income and decreases through expenses. The arrows represent the movement of value.

The three so-called Balance Sheet Accounts are Assets, Liabilities, and Equity. Balance Sheet Accounts are used to track the things you own or owe.

Assets is the group of things that you own. Your assets could include a car, cash, a house, stocks, or anything else that has convertible value. Convertible value means that theoretically you could sell the item for cash.

Liabilities is the group of things on which you owe money. Your liabilities could include a car loan, a student loan, a mortgage, your investment margin account, or anything else which you must pay back at some time.

Equity is the same as "net worth." It represents what is left over after you subtract your liabilities from your assets. It can be thought of as the portion of your assets that you own outright, without any debt.

The two Income and Expense Accounts are used to increase or decrease the value of your accounts. Thus, while the balance sheet accounts simply track the value of the things you own or owe, income and expense accounts allow you to change the value of these accounts.

Income is the payment you receive for your time, services you provide, or the use of your money. When you receive a paycheck, for example, that check is a payment for labor you provided to an employer. Other examples of income include commissions, tips, dividend income from stocks, and interest income from bank accounts. Income will always increase the value of your Assets and thus your Equity.

Expense refers to money you spend to purchase goods or services provided by someone else for early consumption. Examples of expenses are a meal at a restaurant, rent, groceries, gas for your car, or tickets to see a play. Expenses will always decrease your Equity. If you pay for the expense immediately, you will decrease your Assets, whereas if you pay for the expense on credit you increase your Liabilities.